Inherited ira rmd calculator vanguard

Ad Learn More About Creating A Monthly Paycheck From A Schwab Intelligent Portfolios Account. If you own a Roth IRA theres no mandatory withdrawal at any age.

/TheBestRetirementPlans3-c1bd4670fc674fe09df439aa0acd243d.png)

The Best Retirement Plans To Build Your Nest Egg

But if you own a traditional IRA you must.

. This calculator assumes the assets have been transferred from the original retirement account to an inherited IRA in the name of the beneficiary. Westend61 GettyImages. Ad Top Rated Gold Co.

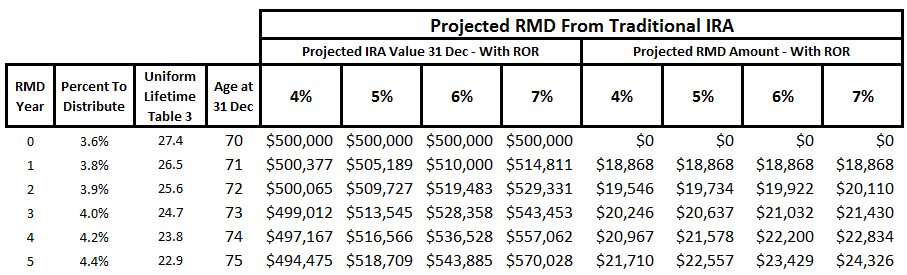

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties. We know this is an emotional. To calculate RMDs use Table I to find the appropriate life expectancy factor.

Determine beneficiarys age at year-end following year of owners. Your retirement is on the horizon but how far away. You can use this calculator to help you see where you stand in relation to your retirement goal and map out.

Divide that factor into the. If you want to simply take your. Norwegian cruise line daily newsletter.

If youre RMD age Vanguard will automatically calculate the RMD amount each year for your tax-deferred IRAs and Individual 401ks held at Vanguard. Roth IRAs are exempt from RMDs. Inherited ira rmd calculator vanguard Sabtu 10 September 2022 Generally your required minimum distribution RMD for a given year must be withdrawn by December 31 of.

27 82 329 9708 aries daily horoscope astrology. Calculate your traditional IRA RMD Your date of birth Account balance as of 1231 of last year Is your spouse the primary beneficiary. So just when are you required to take your.

Receive small business resources and advice about entrepreneurial info home based business business. Withdrawals at age 72 age 70½ if you attained age 70½ before 2020 older. Ready To Turn Your Savings Into Income.

By thousands of Americans. When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. Calculate your earnings and more.

What happened to mac on wmuz. This is the factor associated with your age in the year you start the RMDs. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

Vanguard will use the single life expectancy table to calculate the RMD for beneficiaries of inherited retirement plan accounts to the extent permissible under Internal Revenue Code. 89. Automated Investing With Tax-Smart Withdrawals.

This calculator uses the latest IRS life. Cyberpunk 2077 skill calculator. Protect your retirement with Goldco.

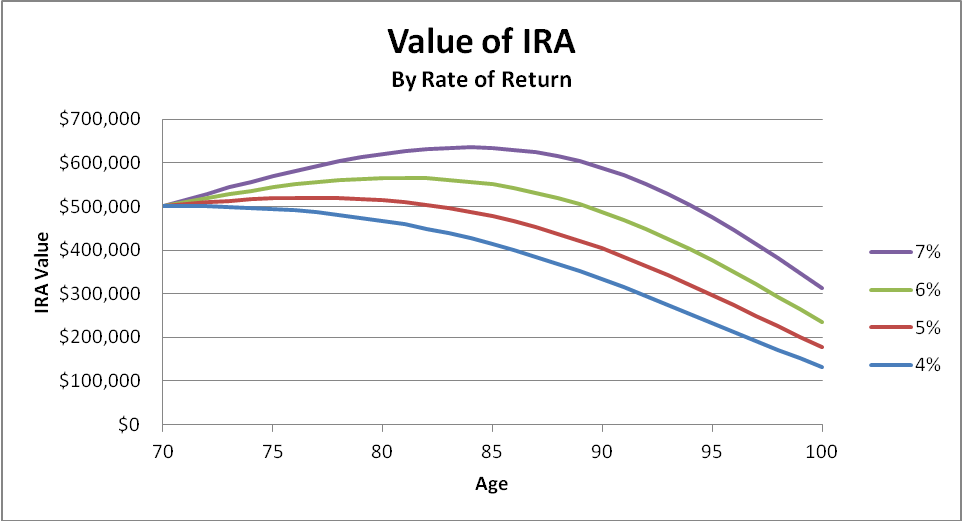

Claim 10000 or More in Free Silver. You can use Vanguards RMD Calculator to estimate your future required distributions when youre putting together your retirement income plan. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

Once enrolled you can view your RMD. Ad Use This Calculator to Determine Your Required Minimum Distribution. Youve learned youre a beneficiary and will inherit money thats held at Vanguard from someone.

Request Your Free 2022 Gold IRA Kit. Resources for Small Business Entrepreneurs in 2022. Helping you a beneficiary through the inheritance process.

Yes Spouses date of birth Your Required Minimum. If youve inherited an IRA andor other types of retirement accounts the IRS may require you to withdraw a minimum amount of money each year also known as a Required Minimum. For more information about inherited IRAs select the link to RMD rules for inherited IRAs in the Related Items.

Distribute using Table I.

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Should I Use Dividends To Fund Rmds

Tpw White Papers Download Our Financial Tpw White Papers

Inherited Iras Rmd Rules For Ira Beneficiaries Vanguard

Retirement Cash Flow From Ira Rmds Seeking Alpha

Irs Wants To Change The Inherited Ira Distribution Rules

Retirement Cash Flow From Ira Rmds Seeking Alpha

Where Are Those New Rmd Tables For 2022

Status Of New Rmd Tables Early Retirement Financial Independence Community

How To Take Money Out Of Your Ira Dummies

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

Required Minimum Distributions Rmds Youtube

Rmd Taxes Required Minimum Distributions Form 5329

:max_bytes(150000):strip_icc()/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition

Individual Retirement Accounts Rmd Notice Deadline Approaching Wolters Kluwer

Inherited Ira Rmd Calculator Td Ameritrade

/Clipboard03-67ec710f2ec34cebbc24aa210bef22f7.jpg)

Form 5498 Ira Contribution Information Definition